FEBRUARY MARKET - 'BLAME IT ON THE WEATHER'

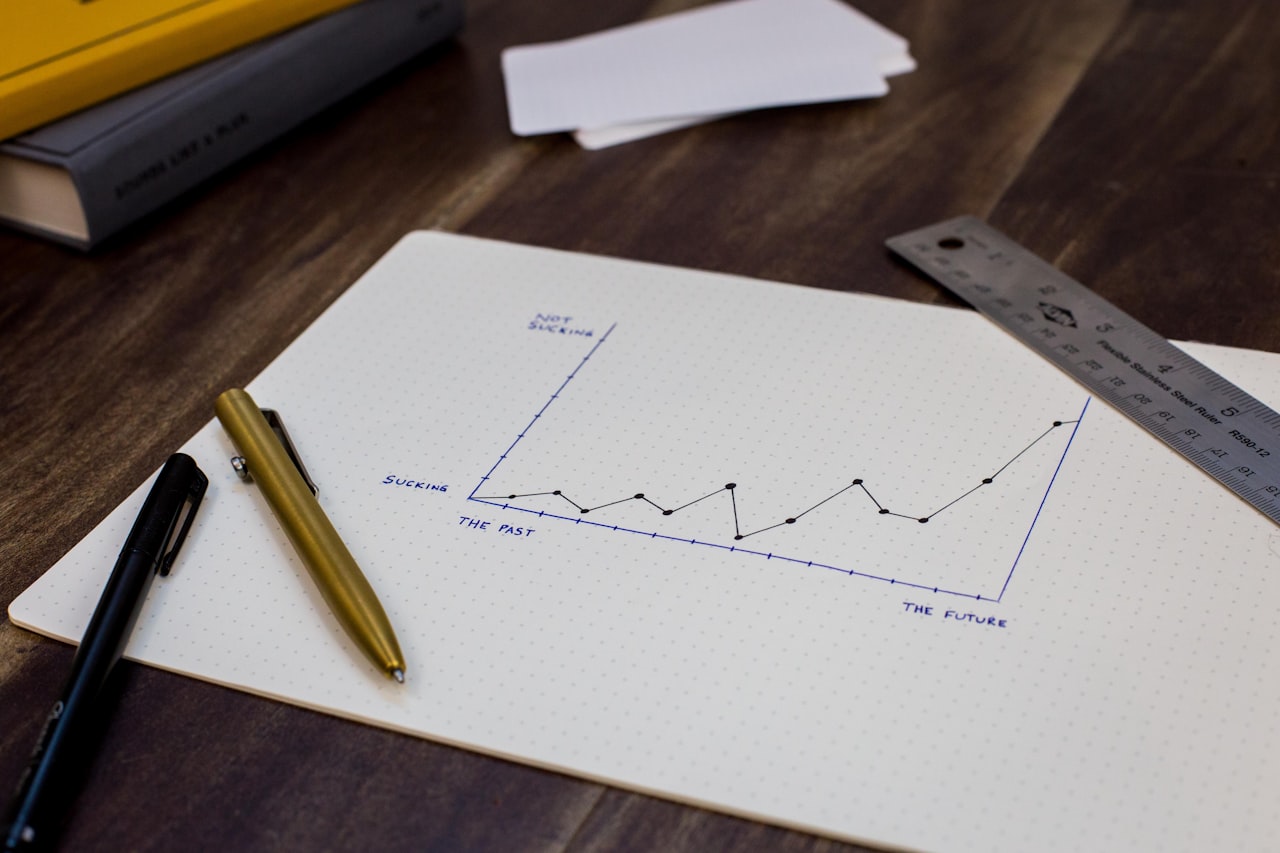

TREB reported February sales in the GTA slipped 2.4% from last year and new listings were down 6.2 percent. The average price was up 1.6% overall. “This varies greatly by area” says Kevin Larose of the Larose Real Estate Team. “If you have a well-priced house that has been nicely renovated in a coveted neighbourhood, it will sell quickly and most often, in multiple offers. Our job as professional real estate consultants is to assess how your property measures up to these 3 factors.”

Weak sales in the GTA in February were also driven by unusually bad weather. “We will have to wait and see what March brings to get a better feel for how the market is going to shape up” says Kevin.

“The important factors to watch right now are what will happen with interest rates, and if parameters around the stress test will change.”

Interest rates aren’t expected to rise again this year. On March 6th, the Bank Of Canada decided to hold its key interest rate at 1.75% - a complete reversal of what was expected from the end of 2018. The BOC is evaluating its ‘new neutral’ – the level at which interest rates neither stimulate or dampen economic growth. This rate has historically been set around 2.5 to 3.5 %. The next BOC rate announcement is scheduled for April 24th and given the current economic outlook, the BOC may need to strike quickly with a rate cut this spring.

Toronto realtors have made a point of calling out for changes to the federal stress test rules which have already helped cool the market and bring down home prices. Approximately 10% of buyers no longer qualify for a mortgage with the big banks and home buyers desperate to enter the market are seeking out unsecured lenders. It has also created a shortage of rental properties as buyers not able to qualify are looking to rent. According to data from CMHC- homes in the GTA area are 5.3% less expensive than they were last year at this time. This adds up to a $40,000 average cost decrease. The context in which the stress test was introduced is no longer relevant as interest rates have already increased by 1 percentage point. Home buyers- especially first time buyers have had to prove they can afford to purchase a home based on a 2 per cent higher than actual rate on a 25 year amortization period. “The qualifying standards need to be adjusted to reflect the rate increases that have already taken place. This would only make sense- especially for first time buyers who have finally saved up enough to buy” according to Kevin.

If you are considering a move this spring, contact us at (905) 278-7355or email [email protected]

'GENERATING VISION' IN LAKEVIEW

Earlier last year, Argo Land Development emerged as the winner of an auction that saw Ontario Power Generation sell off the former 177 hectre Lakeview Generating Station lands for $275-million. Lakeview Community Partners, the development consortium Argo heads, will spend the next 10 to 15 years cleaning up the site and building a lakefront hub with up to 8,000 residential units as well as hundreds of thousands of square feet of commercial, institutional and cultural amenities, all huddled on a striking but derelict swath of Mississauga’s waterfront.

The project – unprecedented in scale for the western GTA – will feature a range of residential formats, including mid-rise condos, towers up to 25 stories and townhouses, as well as retail and other commercial uses. During extensive local consultations, area residents signed on to a plan that proposes significantly more density than would normally be found on a traditional suburban site, but also less than the cluster of high-rise towers that have sprung up around the mouth of the Humber River. The first occupancies are expected in 2023.

The property is about halfway between two GO stations that have been targeted for intensification. This will accommodate for a significant amount of Mississauga’s future growth.

Part of the Lakeview deal involves a dedication of 67 acres of parkland to the municipality, including the pier, as well as land along the water’s edge and a former canal that served as a cooling structure for the generating plant. Peel Region and two conservation authorities are also building a wetland immediately to the east of the property, just south of a large water-treatment plant. A waterfront bike path, long routed around the generating-station site, will traverse the water’s edge and link to waterfront parks both to the east and the west.

Initiall a community group organized by Jim Tovey, a future south Mississauga city councillor, pushed hard to reclaim and redevelop the Lakeview lands – a process that led to an ambitious official plan amendment that lays out not only new urban uses but also allows for the possibility of sustainable infrastructure, such as district energy.

Tragically, Mr. Tovey died last January, just months before OPG completed the land sale. His successor, a former political aide named Stephen Dasko, is seen as fully supportive of the project. The wetland park will bear Mr. Tovey’s name.

Source: The Globe & Mail

CONDO MARKET UPDATE

The Toronto Real Estate Board (TREB) just released their February stats, and while sales are down year-over-year, new listings have also declined, and this could be a sign that a tighter market usually means a more expensive one.

But while the market is still tight, things did pick up month-over-month in Mississauga. In Mississauga’s condo market this past February, the average price was $445,854, compared to $411,561 from the previous year.

There were 199 condo sales in February 2019, compared to 197 condo sales in February 2018. There was the same exact amount of new Mississauga condo listings -272- this year and last year. There was just a slight decrease in active listings, with 239 active listings last month compared to 263 active listings in February 2018.

There was a definite change in the amount of average days on market for Mississauga condos, which was 17 average days this year compared to 23 days last February.

The late-winter market generally saw more action than in January, with sales improving throughout Mississauga. Many speculate that the lack of new listings is limiting buyer choice and driving competition, as sellers are likely waiting for warmer temperatures before listing their homes.

Source: TREB