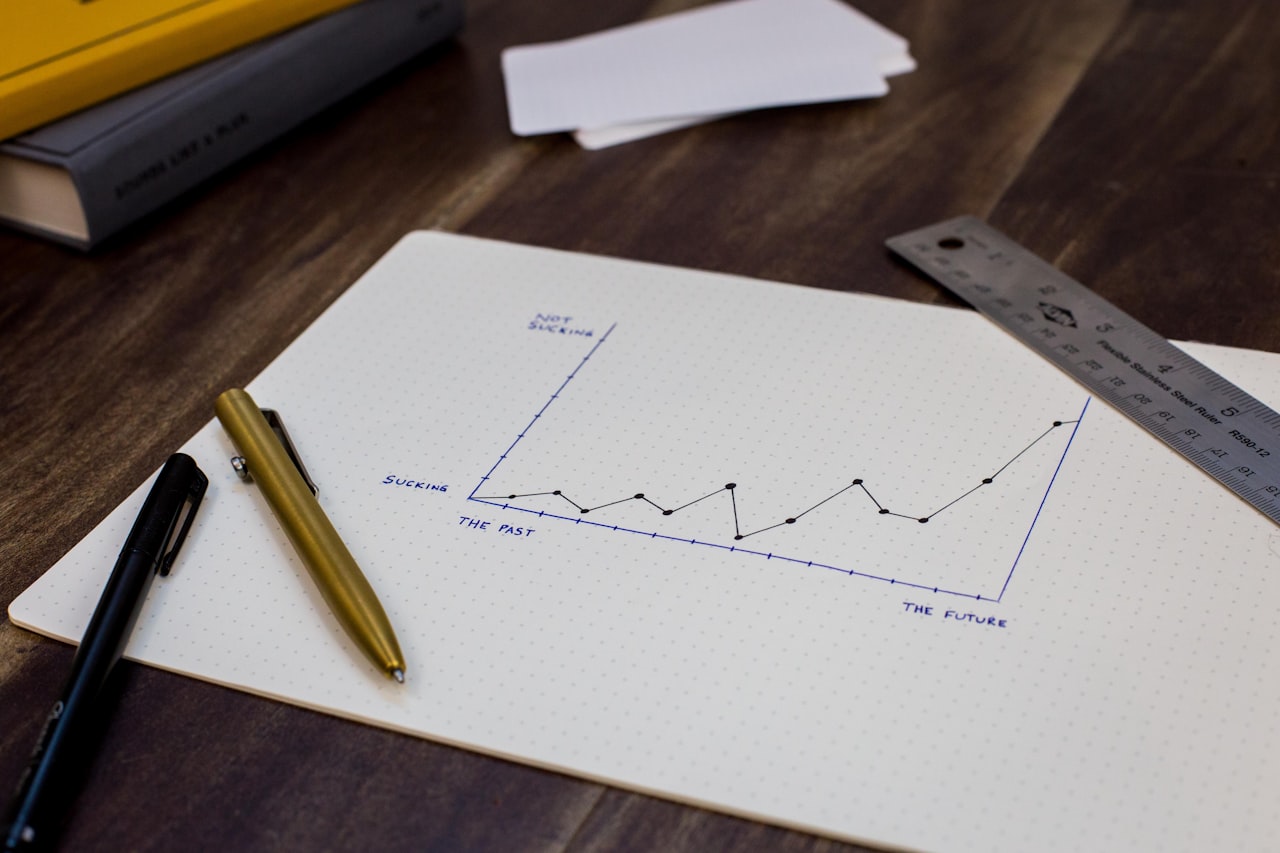

‘Sales were up in August and we forecast a strong fall season’ says Kevin Larose for the Larose Team. We are experiencing some inventory shortages in some of our key areas and are working on digging up private deals for buyers that we have looking for a good property here in Port Credit. ‘There just haven’t been enough good properties for sale this year’ says Kevin.

In Mississauga, overall unit sales were up 12% in August and the average price was up 10%. This is a significant change from what we have been experiencing this spring as markets last year started to level off in the 2nd quarter. Active listings are down 6% to last year which has accounted for some of the price gains. The market is very balanced right now with about 2.2 months of supply and a days on market average of 25. This bodes well for both buyers and sellers.

Looking ahead, buyers will continue to face higher interest rates and tighter policies surrounding mortgages. This will keep home sales activity in check for the balance of this year and into 2019 predicts RBC Chief Economist Dawn Desjardin. We continue to see a large influx of immigration here in Ontario which is keeping the demand for housing high. Mortgage rate increases will be the deciding factor on how the housing market will fare next year. Uncertainty around the NAFTA agreement also plays a factor.

‘We have to understand the housing market is affected more by what is going on locally in our community’ says Kevin. With a strong economy and many housing projects planned here along the Lakeshore corridor, we don’t see prices decreasing anytime soon.

What does this mean for sellers? Home prices have appreciated 37% over the past 3 years here in the GTA. We don’t anticipate any increases like this over the next 2 years. It’s a great time to sell.

For Buyers- interest rates are expected to increase once more this year and by a half a point next year. This will mean more interest payments on mew mortgages- time to buy is right.

For a confidential and professional market evaluation, please contact us at (905) 278-7355 or email[email protected]

The hot topic over the past few weeks in the media is the new Supreme Court ruling that forces the Toronto Real Estate Board, the largest board in the world, to grant access to past sales data to brokerages all across the GTA via a new data feed.

The major difference is up until now, Realtors have had to pull this data manually and email it to our clients. Just to clarify- the data has been available for many years on other websites such as Geowarehouse or Teranet- but for a fee.

What this means is 2 years worth of past sold data will be available via a new data feed to all Treb members who will now be allowed to use the feed to post data on password protected websites. This feed in being made available as this newsletter is bring published- although access is coming slowly due to high demand. With over 50,000 members, you can expect there will delays in obtaining archived data from transactions back to September 2016.

Understand you will only be able to get this sold data by accessing a Realtor password protected site. We will have the data shortly and will make past sales available through our site at www.homesoldprices.ca.

As you can imagine, TREB was inundated with requests and we are processing them in the order that we receive them. We expect to roll out solds to the public over the coming weeks. We ask your patience as we work through the details of this new process with TREB.

Interested in signing on to our password protected VOW site--- sign up at www.homesoldprices.ca

CONDO PRICE GAINS CONTINUE UPWARD TREND

The real estate market in the GTA has seen demand move high throughout the summer, especially in the month of August, which is known to show less real estate activity.

According to the Toronto Real Estate Board (TREB), in Mississauga, condo apartments saw the biggest price gains with an average price of $418,474- up 9.7% compared to August 2017, when the average price of condo apartments was $381,154.

There were 224 condo sales in August 2018 which didn’t waver too far from the 226 condo sales in August 2017. There was a year over year drop in both new and active listings, with 326 new and 350 active, compared to 388 new listings and 477 active listings in August 2017.

The average days on market period for Mississauga condos was 24 days, which didn’t differ too strongly from 23 days on market the previous year.

Comparatively, in Toronto, TREB numbers show condo apartment prices reached an all-time high in August. TREB reported for a typical condo, a benchmark price of $505,500, in August, up 9.94% from the year before.

“Market conditions in the summer of 2018, including this past August, were tighter than what was experienced in the summer of 2017,” said Jason Mercer, TREB’s Director of Market Analysis, “In August, the annual rate of sales growth outpaced the annual rate of new listings growth.

If you are looking to make a move this fall, please contact us at 905 278-7355 or email [email protected]

LIVE IN THE SOUTH MISSISSAUGA COMMUNITIES?

Download our August Newsletter to see TREB's community stats for number of houses sold, average price, says on market, and sale-to-list price.

Port Credit

Mineola

Lorne Park

Lakeview

Lakeshore Condos

Don't live in one of these areas? We can still provide you with up to the minute market stats. Visit homesoldprices.com to get started!