Curious what your Applewood home would sell for in today’s market? You are not alone. Pricing feels tricky when headlines shift every month and every street has its own rhythm. In this guide, you will learn how value is set in Applewood, which improvements deliver the most return, and the practical steps to list with confidence. Let’s dive in.

How market value is set in Applewood

Start with a Comparative Market Analysis

A Comparative Market Analysis, or CMA, is the foundation for your pricing decision. A local agent selects recent sold homes that match yours as closely as possible, then adjusts for differences such as size, lot, bedrooms and bathrooms, updates, parking, and basement finish. The CMA also compares active and expired listings to read current buyer pressure.

Because Applewood is a distinct pocket within Mississauga, using true neighbourhood comps matters. Micro differences by block, lot orientation, and renovation level can shift value. A well‑built CMA reflects those nuances and gives you a market‑ready range rather than a single number.

Cross‑check with AVMs and appraisals

Automated Valuation Models give you a quick, ballpark estimate based on public data. They are helpful for a starting point, but they often miss things like a legal basement suite, a premium lot, or recent renovations. If your home is unique or high‑value, a professional appraisal can add an extra layer of confidence, especially for lending or estate needs. Most Applewood sellers rely on a CMA, then use an AVM or appraisal as a cross‑check.

Property details that move the price

Small differences add up. When comparing your home to recent sales, expect adjustments for:

- Total finished living area and layout efficiency

- Lot frontage, depth, orientation, and overall usability

- Bedroom and bathroom count, including a powder room on the main level

- Basement finish and functionality, including any legal secondary suite

- Garage type and parking capacity

- Age and quality of major updates such as kitchen, baths, roof, windows, HVAC

- Overall condition, curb appeal, and unique features like a pool or exceptional landscaping

Documenting why each adjustment is made creates a defensible valuation and a pricing strategy you can trust.

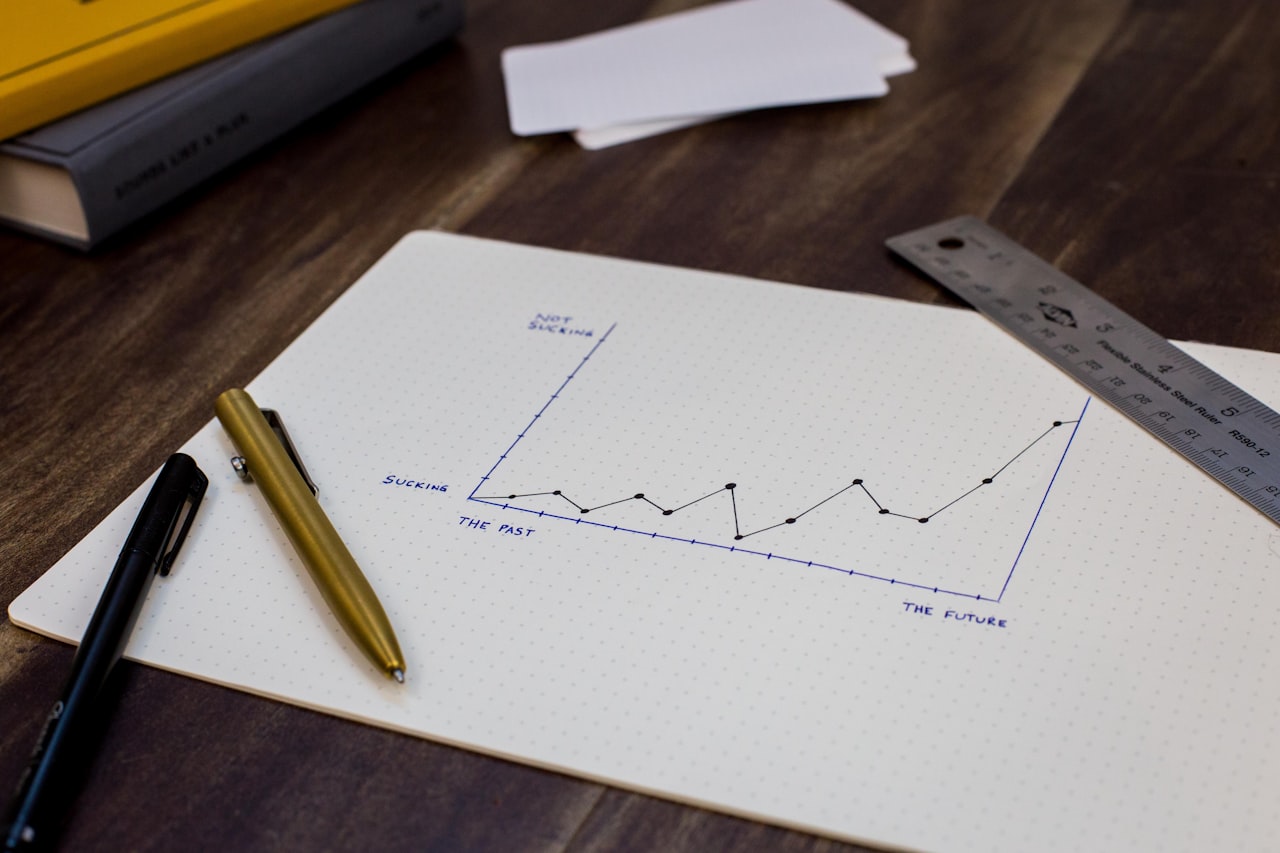

Read the Applewood market

Key numbers to track

To understand where your home fits, look at Applewood and nearby pockets over the last 3 to 6 months. Focus on:

- Sold prices by property type, plus median and average

- List‑to‑sale price ratio, which signals negotiating power

- Days on market, a leading indicator of buyer demand

- Inventory and months of supply, which show whether sellers or buyers have the edge

- Price per finished square foot and short‑term trends

- New listings compared to cancelled or expired listings

These metrics help set expectations for timing, competition, and pricing.

Local drivers that shape demand

Applewood blends low‑rise homes and townhouses, and property type strongly shapes the buyer pool. Lot size and orientation can create a premium. Renovations and finished basements matter because many homes are older and updates vary widely. Proximity to major transit and commuter routes influences interest, and access to parks, community spaces, and retail adds convenience. Keep an eye on nearby development that could affect supply and buyer preferences.

What to fix before you list

Low‑cost, high‑impact updates

You do not have to renovate to sell well. In Applewood and across the GTA, these items typically deliver strong returns:

- Deep clean, declutter, and depersonalize to maximize perceived space

- Neutral interior paint and modern lighting to freshen rooms

- Refinish or replace tired flooring where it matters most

- Curb appeal updates such as landscaping, pressure washing, and a crisp front door

- Minor repairs for obvious wear, plus tune‑ups for plumbing and electrical fixtures

- Professional staging, even light staging, to highlight scale and function

These steps boost buyer confidence and photography quality, often at modest cost.

Conditional upgrades, proceed with a plan

Some projects can add value, but returns vary by property and price point:

- Kitchen refreshes, like painted cabinets and updated hardware, often pencil better than a full gut

- Bathroom updates, such as new fixtures and re‑grouting, show well without the timeline of a full remodel

- Basement finishing can add valuable living area, provided height, layout, and permits align with market expectations

- Energy‑efficiency upgrades may appeal to buyers and can qualify for programs, but confirm current incentives and costs

Match the scope to your target list price and the neighbourhood ceiling.

When to skip major renos

Hold off on big projects if they will push you above the price ceiling on your street, delay your timeline into a slower season, or create a highly personalized look. In most cases, simple improvements and standout presentation deliver a better net.

Ontario rules and paperwork basics

Selling a home in Ontario involves specific obligations and documents. Work with a licensed professional who follows the Real Estate and Business Brokers Act and is regulated by the Real Estate Council of Ontario. Your agent should explain representation agreements and your disclosure duties.

Sellers must not knowingly misrepresent the property’s condition. Many complete a Seller Property Information form to address common questions. Confirm that past renovations were permitted and closed, and gather receipts and warranties for major systems.

MPAC’s assessed value is used for property taxes and does not equal market value. For condominiums, a status certificate is essential for buyers and can affect timelines. Offers often include conditions such as financing or inspection. For most resale homes, HST does not apply to the property itself, though it can apply to certain services involved in the transaction. Your legal advisor can confirm the details for your situation.

Build a pricing strategy

A smart strategy balances your goals with market signals. Here are common approaches:

- Competitive pricing: Price slightly below a strong comparable to spark interest and encourage multiple offers. This works best when inventory is tight and buyer demand is clear.

- Market‑value pricing: Set the list price near the CMA range to attract the most qualified buyers comparing similar homes.

- Overpricing caution: Pricing high often leads to longer days on market, then reductions that can weaken your position.

You can also plan how you will handle offers with conditions compared to firm offers, depending on your timing and risk tolerance. Seasonality matters too. Activity often picks up in spring and early fall, while winter can be quieter. Track the last 3 to 6 months of Applewood data to match your strategy to what buyers are doing right now.

Simple Applewood seller checklist

- Request a CMA using Applewood comps from the last 3 to 6 months

- Pull your MPAC assessment and property tax notices

- Gather renovation permits, receipts, warranties, and utility bills

- Compile floor plans or measurements and any recent survey or lot sketch

- Decide on a pre‑listing inspection or appraisal if your home is unique

- Complete quick prep: declutter, paint, curb appeal, minor repairs, and staging

- Compare a few automated estimates to your CMA, then discuss differences with your agent

- Align on a pricing and marketing plan that defines your reserve price, target buyer pool, and negotiation strategy

How the Larose Team helps you sell with confidence

You deserve a valuation and listing plan that reflects the nuances of Applewood. The Larose Team brings 25 plus years of local experience, a concierge listing process, and premium presentation designed to unlock value. Our team handles staging, in‑house photography, and coordinated vendor support so your home shows at its best online and in person.

Backed by Royal LePage resources and national distribution, we combine neighbourhood‑level expertise with broader reach. You get a clear, data‑driven price range, a step‑by‑step prep plan, and a marketing strategy that meets buyers where they are. When you are ready, we will build your CMA, walk you through recommended updates, and guide you from first showing to firm sale.

Ready to learn what your Applewood home could sell for? Request your Free Home Valuation with the Larose Team.

FAQs

Is MPAC value the same as market value in Applewood?

- No. MPAC sets assessed value for property taxes, while market value is based on recent comparable sales and current buyer demand.

How long does it take to sell a home in Applewood?

- Timing depends on price, condition, and demand. Track days on market and months of supply for your property type to set a realistic expectation.

Do I need a pre‑listing home inspection?

- It is optional. A pre‑listing inspection can reduce surprises, help you decide what to repair, and build buyer confidence.

How are comparable sales chosen for my Applewood home?

- Start with similar homes sold in the last 3 to 6 months within Applewood, then adjust for size, lot, beds and baths, updates, basement finish, and parking.

What if my Applewood home is unique or hard to compare?

- Consider a broader comp search and a professional appraisal. Your marketing should highlight unique features that add value.

What costs should I expect when selling in Ontario?

- Common costs include real estate commission, legal fees, staging or minor improvements, and moving expenses. Your agent and lawyer can outline specifics for your situation.