Trying to decide between a condo near Square One and a freehold on a quiet street in South Mississauga? You are not alone. The choice affects your monthly budget, weekend routine, and future resale options. In this guide, you will learn how freehold and condo ownership work in Ontario, what to compare for total monthly cost, how lifestyle differs between City Centre and nearby neighborhoods, and the steps to take before you write an offer. Let’s dive in.

Freehold vs condo basics

What freehold means in Ontario

A freehold owner holds title to the home and the land beneath it. You control maintenance, renovations, and exterior changes, subject to municipal rules. You pay your own property taxes, utilities, home insurance, and all repairs. This option suits buyers who want space, privacy, and control.

What a condo is and how it works

A condo owner holds title to a unit and a shared interest in the common elements. A condominium corporation manages those shared elements and charges monthly condo fees. Fees typically fund building insurance for common areas, staffing, utilities where included, daily operations, and reserve fund contributions for future repairs. Condo ownership reduces exterior maintenance but adds a layer of shared governance and rules.

Key legal items to review

For condos, plan to review at least these items during due diligence:

- Status certificate and most recent reserve fund study

- Financial statements, insurance summary for common elements, and minutes of recent owner meetings

- Rules on pets, renovations, rentals, and any ongoing litigation or special assessments

For freeholds, review:

- Clear title, any easements or encumbrances, and municipal compliance

- Recent utility and property tax history

- Inspection results and age of major systems

Mississauga lifestyle fit

City Centre condo living

Mississauga City Centre is a high-density hub anchored by Square One and major transit connections. Condos here often have lower entry prices than nearby freeholds, plus amenities like gyms, party rooms, concierge, and visitor parking. You will likely enjoy shorter to-do lists for maintenance and strong walkability to shopping, restaurants, and cultural venues. Consider parking availability, storage, and building rules as part of your decision.

Nearby freehold neighborhoods

Freehold choices near City Centre include areas such as Cooksville, Port Credit, Clarkson, Erin Mills, Lorne Park, and Mineola. These neighborhoods offer more space, private outdoor areas, driveways or garages, and flexibility for renovations. You will take on full responsibility for exterior work and larger systems like roofs and HVAC. Expect a different rhythm of life, with more time in the yard and a stronger sense of property autonomy.

Parking, transit, and daily routines

Condo parking may be owned or leased and sometimes limited, with visitor parking in short supply at peak times. Freeholds usually provide driveway and garage parking, with on-street rules that vary by neighborhood. Transit improvements and new development around City Centre influence condo demand, while established freehold areas often trade on stability and limited land supply. Think about your vehicle needs, commute, and weekend habits.

Costs to compare

One-time purchase costs

Budget for purchase price, land transfer tax at the provincial level, legal fees and registration, and mortgage-related costs such as appraisals. If your down payment is below certain thresholds, mortgage insurance may apply. Mississauga does not levy a separate municipal land transfer tax. Avoid relying on static figures and confirm current amounts with your lender and lawyer.

Monthly carrying costs

Your monthly budget should include:

- Mortgage payment

- Property taxes

- Condo fees if buying a condo

- Utilities you pay directly, such as electricity, gas, internet

- Home insurance

- A maintenance reserve for future repairs

Freeholds usually require a larger maintenance reserve because you cover big-ticket items. Condos shift many building costs into the monthly fee and reserve fund, but fees can rise over time.

Maintenance, reserves, and special assessments

Freehold owners plan and pay for their own capital items like roofs, windows, HVAC, and exterior repairs. Condo corporations plan major projects through reserve funds. When reserves are inadequate, special assessments can occur and increase your costs. Review the reserve fund study and status certificate to understand the building’s health.

Build your monthly worksheet

Use this simple method to compare options side by side:

- Start with your mortgage payment.

- Add monthly property taxes.

- Add condo fees if applicable.

- Add utilities you pay directly.

- Add home insurance.

- Add a monthly maintenance reserve. For freeholds, many owners set aside a modest percentage of property value each year. For condos, include a smaller contingency plus awareness of special assessment risk.

The total is your total monthly occupancy cost. Compare this number across properties to keep the decision clear and practical.

Resale dynamics and risks

Condo resale patterns

Condos attract first-time buyers, downsizers, and investors, which supports a broad resale pool. Prices can be sensitive to new construction supply, fee levels, and building reputation. Governance issues, litigation, and underfunded reserves can reduce buyer interest and pressure values. Evaluate building-level factors as carefully as the unit itself.

Freehold resale patterns

Freeholds tend to draw families and move-up buyers, with limited land supply in mature areas supporting long-term value. Condition, layout, and curb appeal carry significant weight. Deferred maintenance, age of major systems, and drainage or zoning constraints can limit resale prospects. A well-maintained property usually sells faster and with fewer surprises.

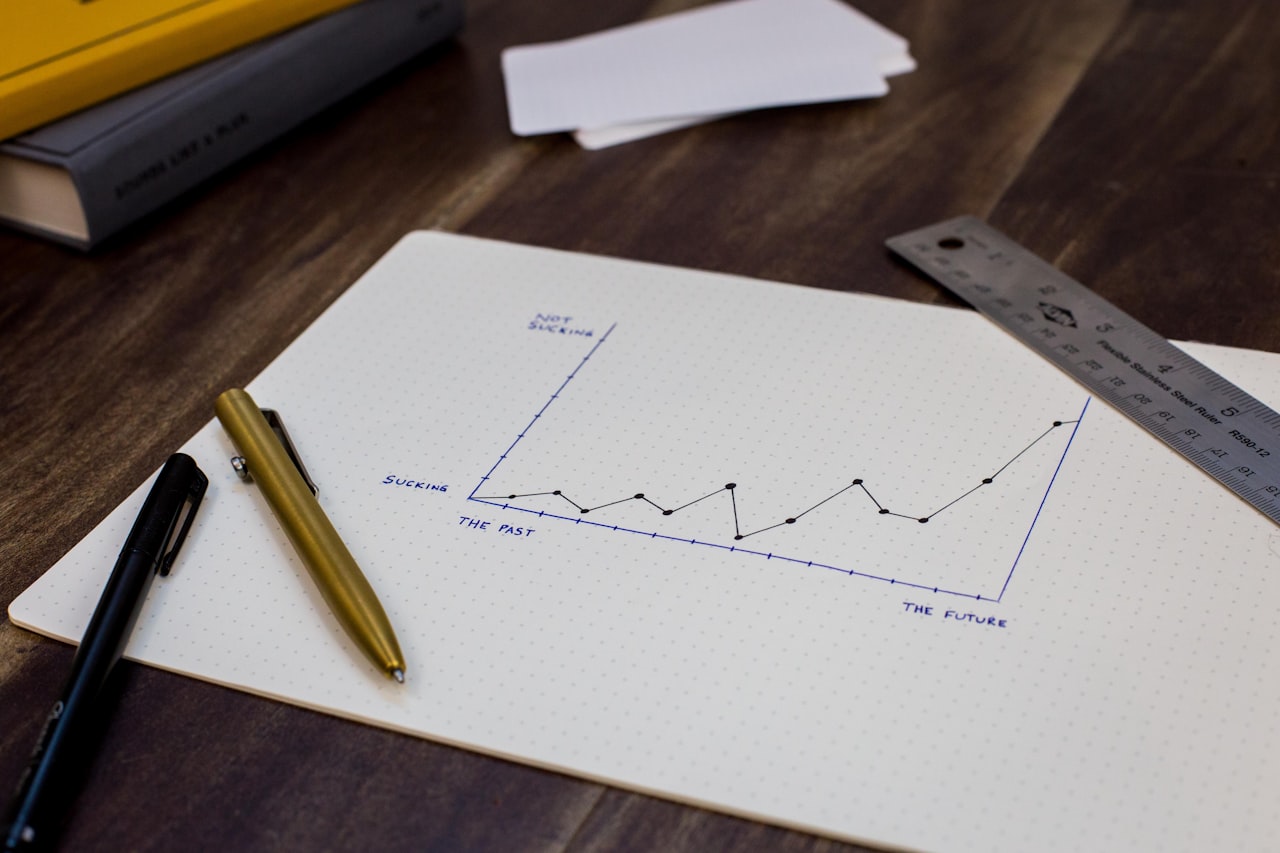

Time horizon and liquidity

If you plan to move within one to three years, transaction costs and market timing matter more. In some price bands condos sell quickly due to affordability, while in others freeholds may lead. Over longer horizons, lifestyle fit, cumulative maintenance, and neighborhood character often drive satisfaction and outcomes.

Decision checklist

Use these prompts to clarify your fit:

- Budget: Which option produces a comfortable total monthly occupancy cost, including a maintenance reserve?

- Lifestyle: Do you prefer walkability and amenities or private yard space and storage?

- Control vs convenience: Are you comfortable with condo rules or do you want full autonomy over your property?

- Time horizon: Short-term hold or long-term home base?

- Risk tolerance: Are you prepared for condo governance tradeoffs and potential special assessments?

- Parking and vehicles: How many spots do you need today and in the future?

- Family needs: Do bedrooms, play space, and school catchments align with your plans?

Pre-offer due diligence

Condo buyer checklist

- Obtain the status certificate and latest reserve fund study

- Review financial statements, minutes of owner meetings, and insurance scope

- Confirm what fees cover and identify any planned increases

- Verify parking and locker ownership or lease terms and visitor parking policies

- Check pet rules, occupancy limits, rental restrictions, and rule enforcement

- Ask about special assessments, litigation, and management company reputation

Freehold buyer checklist

- Schedule a full home inspection

- Verify boundaries, easements, and any encroachments

- Review age and condition of roof, windows, HVAC, foundation, and drainage

- Confirm property tax history and zoning or official plan details

Professionals to consult

Work with a local real estate agent, mortgage broker or lender, real estate lawyer, home inspector, and insurance broker. For complex condo issues, a condominium lawyer or consultant can help. When possible, seek operational insights from the building or property manager.

How the Larose Team helps

You deserve a calm, well-structured buying experience grounded in local expertise. Our team pairs neighborhood-level guidance across South Mississauga with a concierge process that keeps every step organized. From refining your total monthly cost to reviewing building health and preparing a winning offer, we give you practical advice that aligns with your goals. Ready to compare City Centre condos with nearby freeholds and choose with confidence? Connect with the Larose Team for tailored guidance and next steps.

FAQs

What is the main difference between condo and freehold ownership?

- In a condo you own the unit plus a share of common elements and pay monthly fees; in a freehold you own the home and land and handle all maintenance yourself.

How do I estimate the true monthly cost before buying?

- Build a worksheet that adds mortgage, property taxes, condo fees if applicable, utilities, insurance, and a maintenance reserve to get a total monthly occupancy cost.

What documents should I review for a Mississauga condo purchase?

- Ask for the status certificate, reserve fund study, financials, insurance summary, recent minutes, and disclosures about litigation or special assessments.

Are condo fees predictable over time?

- Not fully. Well-run corporations with current reserve studies tend to plan increases, but underfunded buildings may need special assessments that raise costs.

How do City Centre condos compare to nearby freeholds for lifestyle?

- City Centre offers walkable access to transit, shops, and amenities with less exterior maintenance; nearby freeholds provide more space, yards, parking, and autonomy.

Which has better resale potential in Mississauga: condo or freehold?

- It depends on supply, building or property condition, and price band. Freeholds benefit from limited land supply, while condos draw larger buyer pools at certain price points.